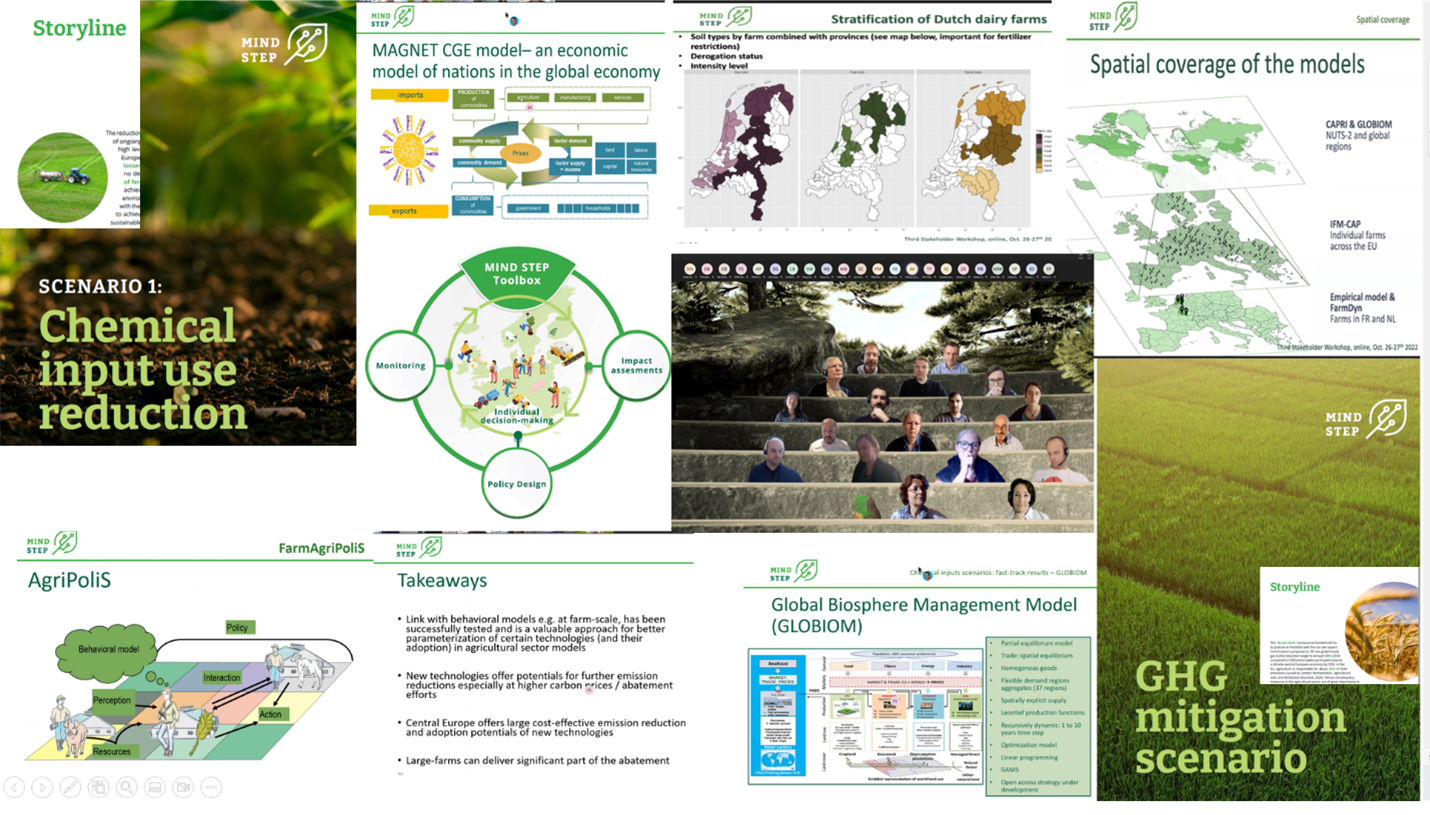

Over the last three years, MIND STEP partners have developed a toolbox of data and models for analysing EU agricultural and environmental policy. The purpose of this workshop was to present the first results, and the MIND STEP consortium wanted to hear the experience and insights of key experts in the modelling and agriculture sector within the project's stakeholder group to improve the MIND STEP simulation activities further.

The 3rd MIND STEP stakeholder workshop was held entirely online on the premises of Stichting Wageningen Research on 26-27 October 2022. It reunited 29 participants, including project partners involved in stakeholder engagement and modeling activities (the modeling team). In addition, various representatives of the European Commission (DG-AGRI) attended, as well as representatives from the University of Parma and sister projects (AGRICORE), Institute of Agricultural Economics in Hungary (AKI), OECD, Aristotle University of Thessaloniki, Ministry of Agriculture of the Netherlands and Wageningen Economic Research, the Ministry of Agriculture of Bulgaria, Polytechnical University of Madrid, and ETH Zurich.

The MIND STEP project coordinator welcomed everybody and chaired the first session, giving an overview of the policy background and the MIND STEP approach to simulate policy, followed by representatives of IIASA, presenting the topic of nitrogen reduction targets in agriculture at the farm and sector level. Next, representatives from the modeling team presented the selected results of the MIND STEP approach to simulate policy impacts and introduce the dynamic of break-out groups. Finally, in DAY 2, presentations on the impact of GHG emissions reductions on the farm and sector level (WR) and modeling team representatives (IAMO) were given to re-start the second part of the break-out group discussions.

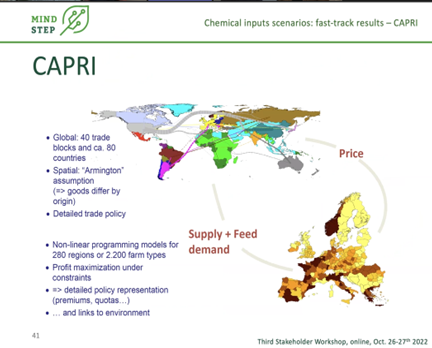

Participants split into three breakout groups during both days focused on: a. Scenario assumptions and results, b. Management & technology, and c. Policy design. On DAY 1, Group a (scenario assumptions and results), chaired by IIASA, asked questions such as: the use of marginal social damages, the use of different taxation rates and what type of fertilizers used (ammonia and urea) and considered in the FarmDyn model, as well as the crop rotation, were part of the conversation. It was clarified that, in reality, farmers have many more options than in the models and that MIND STEP partners need to be transparent on what models can and cannot do, referring to the static vs. dynamic models, which are tricky to implement. There were questions about the high-level scenario-assumptions and the possibility of comparable solid results, to which IAMO representative responded that all models have their value as they focus on different aspects; other members of the Group mentioned that models should be considered as complementary aspects, that trade comparison between that global models would be interesting and that the combination of models is key and planned.

On DAY 2, the Group a discussions focused on including other farm types, such as the beef sector, more farm management measures and finding out about the cost and potential mitigation measures, and considering the feasibility of scenarios such as the tax or structural change. Also, energy prices are central and should influence future scenarios, and the uncertainty related to energy prices is high but expected to continue over the next two years. It was also mentioned that MIND STEP aims to build up from farm-level to sector level, and that some empirical models already exist for the Netherlands, France, and Italy. However, boundary conditions are given by FADN data, and cropland activities vary by Member States. The possibility of creating representative farms was brought up, to which WUR representatives replied that some extrapolation is possible, but data and mechanisation level may vary from country to country.

The Group B (management and technology) discussions centred on a joint assessment with stakeholders about Nitrogen input use technologies/farm management measures; discussion on barriers to the widespread adoption of mitigation technologies. Among the questions that stakeholders answered were the following: What could be potential reactions/adaptation strategies of farms? What farm management measures are we missing? What could be the impact of the Nitrogen reduction target on investments and farm size/structural change? What could be the impact of R&D on input use? WUR representative taked about the Grass silage and that is has higher protein content when it is harvested in its early stages. One solution is to change to intensive grassland to harvest more protein per ha without increasing N use. Problem - grassland not well covered by data. Therefore, there is ongoing research to combine data from remote sensing with the existing databases. Also, it was highlighted that under the given scenarios, will each farm reduce the animal size by, for example, 20% or 20% of farms drop out of business, and only large farms will survive? None of our models can currently capture this effect. It was mentioned that fixed costs of the technologies shall also be considered, not only VC.

Moreover, short- and long-term effects should be considered. Although, as an example, in Capri, for specific technologies, it is assumed that fixed costs are farm size dependent. However, we also believe that adopting technologies in the long term is better.

The consideration of fixed costs also depends on whether the technology is applied through contractors or farmers need to purchase the technology. Regarding dairy management plans, nitrification inhibitors (NI) are an effective, increased legume share. Feed additives – reduce N in manure. The other participants were unaware of any feed additives that reduce N in manure and asked for more specific references (papers, ongoing projects, etc.). A representative from JRC mentioned that Mitigation technologies operate at the management level; they are more detailed than our models. JRC is scaling up something particular at the management level based on many assumptions. How reliable are the results then? The precision of the results is problematic. Models like Farmdyn are more appropriate for modeling mitigation technologies, but they can’t scale up the results. He mentioned that uptake should not be overlooked and that uncertainties should be addressed by stochastic modelling. WR representatives posed questions for further conversations, such as 1. will the Gains database be helpful for IFM-CAP? 2. How is the uptake of the mitigation technologies modelled? 3. Is it purely based on competitiveness, or are other factors influencing this decision? N application is not very elastic, and high taxes are needed to reach the desired levels of reduction. The conclusions of this break-out group can be summarised as following:

- Impressive set of mitigation options;

- Adoption of measures. Farmer’s characteristics are difficult to model. Mismatch between modelled measures and potential adoption of measures;

- Also take trade-offs between different environmental issues into account;

- Energy saving measures are also important and could be implemented

- Interaction between measures is important. Models can show this;

- Extending lactation e.g. by breeding can be an important option;

- Bovaer is a high potential mitigation option as well breeding cows with lower CH4 emission factors

Breakout group C (Policy design), chaired by UCSC and INRAE, MIND STEP partners, discussed CO2 taxes; the policy considered during this workshop seems to target two objectives: reducing GHG emissions and reducing nutrient (nitrogen in particular) losses. According to the famous maxim of Tinbergen, two instruments (at least) are likely to be needed to achieve these goals efficiently. This point needs to be clarified when presenting simulations related to CO2 taxe: also, it was discussed that Farmers’ emission (marginal) abatement costs and pollutions’ (marginal) damages are heterogeneous, thereby calling for differentiated tax rates for regulating pollution emissions efficiently. This point needs to be discussed when discussing simulations of uniform taxes. The more tailored the instrument, the higher its implementation cost (due to monitoring and transaction costs). More generally, the implementation costs of policies, which greatly vary across instruments, deserve more attention. For instance, uniform taxes are relatively cheap to implement. In contrast, subsidy schemes (e.g., AEC schemes, Eco-schemes) or instruments tailored at the farm level (e.g., taxes on nitrogen surpluses) are very expensive. There is a trade-off between the “targeting accuracy” of an instrument and its implementation cost.

Posed questions: Why does the Europan Commission (EC) keeps favoring subsidy schemes such as AEC schemes despite their failures (and implementation costs)? A possible answer could be that the EC always has two objectives: incentivizing changes and maintaining farmers’ income levels. Subsidy schemes seem to be able to kill these two birds with one stone (whereas using two instruments is warranted). The OECD representative made an interesting study investigating the efficiency and acceptance of practice-based (e.g., AEC or Eco- schemes) versus result-based subsidy schemes. Result-based schemes are shown to be the most efficient and favoured by farmers. It was pointed out that the use of the tax revenue is crucial and needs to be considered. Returning the tax revenue to farmers (in the case of taxes on agrochemicals) seems warranted for neutralising as much as possible the (negative) effects of the tax on farm incomes. Yet, not to destroy the incentive effect of the tax is also crucial. Recent increases in fertilizer prices (due to the war in Ukraine) are unfortunate. Still, they could be used for validating, at least to some extent, MIND STEP models regarding their ability to simulate the effects of fertilizer taxes. Yet, one must know whether farmers consider these price increases transitory or more or less “permanent”.

During DAY 2, The breakout group C, started by introducing the participants and voting on the following question: would you choose tax or voluntary measures to achieve GHG emission reduction in agriculture? While some participants clearly expressed their preference for tax measures due to their effectiveness, others favoured combined solutions. First, these can bring synergic effects, and second, they can target multiple objectives. The strengths and weaknesses of the emission tax were debated mainly, as well as how realistic taxation implementation would be; who would be responsible for implementing such a tax? Can this be done in the framework of CAP? It was highlighted that farmers are reluctant to add results–based schemes–they prefer the schemes they are used to. Also, it was pointed out that if implemented as part of CAP – direct payments, there would be lost when no compliance; in the case of taxation, direct payments are untouched, but farmers are charged for tax. Is there some behavioural aspect that would suggest one or the other option would be easier to implement? It was commented that the farmers are generally familiar with the subsidy schemes they come from the past. Introducing constraints on how you get a subsidy, and adopt specific behaviour to obtain subsidies is something that, at least, constraints farmers to adopt specific, let's say, behavioural change.

JRC representatives affirmed that farmers would support the global initiative. Frame farmers to get more subsidies with more mitigation. They (JRC) also established that in the industry they are already working for a long time with CO2 tax and that the key issues is how to communicate the schemes to the farmer community. On the other hand, UNIBONN representatives affirmed that much of the taxation relies on the modelling, making it difficult to measure it precisely. IAMO highlighted that Emission efficiency is included in the models, but the cost of current policies is not. On the topic of the combination of voluntary schemes with taxation, the following questions were posed by IAMO and WUR: 1. What could be good also opportunities in combination with maybe attacks so that we can combine both? 2. How does this work in practice? For instance, in the Netherlands, there have been voluntary measures in the past few years till now. And what is the Dutch Ministry of Agriculture's plan to target GHG reduction in the coming years? In the past few years, farmers had voluntary measures. What is the plan of the Dutch ministry? It was mentioned that measures are coming from the environmental side independent from the subsidies the farmers receive from CAP. The representative of the Ministry of Agriculture of the Netherlands replied that the CAP strategic plan has been published.

Referring to the takeaways, the link with behavioural models e.g. at farm-scale, has been successfully tested as it is a valuable approach for better parameterization of certain technologies in agricultural sector models. Also, new technologies offer the potential for further emission reductions, especially at higher carbon prices and abatement efforts. It was mentioned that Central Europe offers large cost-effective emissions reduction and adoption potentials of new technologies and that large farms can deliver a significant part of the abetment. The workshop's objectives were accomplished by the rich discussion in the breakout groups, which will help further improve the MIND STEP simulation activities.